Your Auto Insurance Card" width="1500" height="844" />

Your Auto Insurance Card" width="1500" height="844" />Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Home › Understanding Auto Insurance › Managing Your Auto Insurance Policy › How to Get a Copy of Your Auto Insurance Card in 2024 (Follow These Steps)

Luke Williams

Insurance and Finance Writer

Luke Williams is a finance, insurance, real estate, and home improvement expert based in Philadelphia, Pennsylvania, specializing in writing and researching for consumers. He studied finance, economics, and communications at Pennsylvania State University and graduated with a degree in Corporate Communications. His insurance and finance writing has been featured on Spoxor, The Good Men Project.

Written by Luke WilliamsInsurance and Finance Writer

Licensed Insurance Producer

Dani Best has been a licensed insurance producer for nearly 10 years. Dani began her insurance career in a sales role with State Farm in 2014. During her time in sales, she graduated with her Bachelors in Psychology from Capella University and is currently earning her Masters in Marriage and Family Therapy. Since 2014, Dani has held and maintains licenses in Life, Disability, Property, and Casualt.

Reviewed by Dani BestLicensed Insurance Producer

UPDATED: Aug 21, 2024

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Aug 21, 2024

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

You can get a copy of your auto insurance card by contacting your insurer, visiting its digital services, seeing an in-person agent, or printing it out yourself.

Your Auto Insurance Card" width="1500" height="844" />

Your Auto Insurance Card" width="1500" height="844" />

Your insurance certificate is a card companies send you after buying a policy. Many states require physical proof of insurance, so always keep it in your wallet or glove compartment.

If you’re thinking, “I lost my car insurance card. What should I do?” keep reading to learn how to get a copy. Enter your ZIP code above to compare car insurance rates .

How to Get a Copy of Your Auto Insurance CardWondering how to get a copy of your car insurance card? Getting a copy of your current insurance information is a fairly easy task.

Read More: Managing Your Auto Insurance PolicyIf you lost the original copy of your proof of insurance, you can always get another copy from your insurance company. The quickest and easiest way to do this is to call your insurance agent directly, who will be able to arrange to mail you another copy.

Your insurance certificate is typically a card issued by your insurer. You should carry this in your wallet or vehicle whenever you drive.

They can send you another copy in the mail, which you should keep on you whenever you drive. In some states, you can face serious penalties for not having physical proof of insurance if you are pulled over by the police or involved in a car accident.

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

You may also be wondering how to get a copy of car insurance online. Another quick way to obtain proof of your insurance is by visiting your provider’s website or mobile app.

Many top insurers offer these digital services for drivers to conveniently access proof of insurance and manage their policy.

Schimri Yoyo Licensed Agent & Financial Advisor

Almost all states, besides New Mexico, allow drivers to present digital proof of insurance in lieu of a physical copy if they get pulled over.

Most of the best auto insurance companies, such as State Farm, Farmers, Allstate, and Liberty Mutual, have in-person agents nationwide ready to assist auto insurance policyholders with getting proof of insurance. While most providers welcome walk-ins, you can also contact your insurance agent to schedule an appointment.

Check out these reviews of top providers:

If you’re not sure where your local agent is, simply use your insurer’s website to locate the nearest one with your ZIP code.

You can also print your digital copy of insurance policy proof if you requested one by email or got it from your insurance company’s online services. It’s important to always carry this copy with you in your vehicle at all times, as some states, such as New Mexico, may ask for physical proof of your insurance.

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

While you’ll need proof of insurance to meet state laws, there may also be other reasons you’re asking how to get a copy of my car insurance.

a Copy of Your Auto Insurance Card" width="1500" height="844" />

a Copy of Your Auto Insurance Card" width="1500" height="844" />

For instance, you’ll need proof of insurance to rent a car if you don’t want to buy coverage directly from the rental car company. You’ll also need your car insurance card handy after you get in an accident.

Check out more in our comprehensive guide: “Do you need proof of insurance to rent a car?”

In addition to almost every state requiring a minimum amount of auto insurance, many states require drivers to carry physical proof of insurance.

In some states, you could face penalties if you are not able to produce physical proof of auto insurance, such as an insurance card from your insurer, even if you have the required amount of auto liability coverage. This means that it is very important that you retain a copy of your proof of insurance whenever you drive your vehicle.

Laws vary by state on this issue, however, it is always best to be able to produce proof of insurance immediately in the event that you are involved in a car accident. Even if your state does not require physical proof of insurance, this can help to expedite the process of filing and resolving your claim after a car accident.

If your insurance information isn’t up to date, you should fix it immediately.

Many state laws require insurance companies to notify the state department of motor vehicles if a driver has canceled or not renewed their policy.

If you find that you don’t have a copy of your insurance card, you can always call your insurance company right away to get an instant auto insurance card if you’d prefer to request a copy over the phone.

Maintaining proof of insurance is vital to managing your auto insurance policy and meeting state auto insurance laws. Reach out to your insurance company or utilize its digital services to get a copy of car insurance proof.

The laws of each state are different regarding what penalties can be imposed on drivers who fail to produce proof of valid auto insurance.

States have steadily increased fines for drivers who do not carry the required minimum auto insurance because they want to encourage every driver to have financial responsibility in assuming the risk of driving a car.

Check out the table below to see what your state’s penalties are for driving without car insurance:

Penalties for Driving Without Auto Insurance by State| States | Penalties |

|---|---|

| Alabama | Fine: Up to $500; registration suspension, $200 reinstatement fee |

| Alaska | License suspension for 90 days |

| Arizona | Fine: $500+; license/registration suspension for 3 months |

| Arkansas | Fine: $50-$250; suspended registration; $20 reinstatement fee; possible impoundment |

| California | Fine: $100-$200; possible impoundment |

| Colorado | Fine: $500+; 4 points; license suspension until proof of insurance |

| Connecticut | Fine: $100-$1000; suspended registration/license for 1 month; $175 reinstatement fee |

| Delaware | Fine: $1500+; license suspension for 6 months |

| Florida | Suspension of license/registration; $150 reinstatement fee |

| Georgia | Suspended registration; $25 lapse fee; $60 reinstatement fee |

| Hawaii | Fine: $500 or community service; 3-month license suspension or 6-month insurance policy |

| Idaho | Fine: $75; license suspension until proof of insurance |

| Illinois | Fine: $500+; license plate suspension until $100 reinstatement fee |

| Indiana | License/registration suspension for 90 days to 1 year |

| Iowa | Fine: $250-$500; possible community service; possible impoundment |

| Kansas | Fine: $300-$1000; possible jail for 6 months; license/registration suspension; $100 reinstatement fee |

| Kentucky | Fine: $500-$1000; possible jail for 90 days; plates/registration revoked for 1 year |

| Louisiana | Fine: $500-$1000; if in accident, registration revoked, driving privileges suspended for 180 days |

| Maine | Fine: $100-$500; license/registration suspension until proof of insurance |

| Maryland | Loss of plates/registration; uninsured motorist penalty fees; $25 restoration fee |

| Massachusetts | Fine: $500-$5000; possible imprisonment for 1 year or less |

| Michigan | Fine: $200-$500; possible imprisonment for 1 year; license suspension for 30 days; $25 service fee |

| Minnesota | Fine: $200-$1000; possible community service; possible imprisonment for 90 days; license/registration revoked for 12 months |

| Mississippi | Fine: $1000; driving privileges suspended for 1 year |

| Missouri | Four points; suspended until proof of insurance; $20 reinstatement fee |

| Montana | Fine: $250-$500; possible imprisonment for 10 days |

| Nebraska | License/registration suspension; $50 reinstatement fee for each |

| Nevada | Fine: $250-$1000; registration suspension; $250 reinstatement fee |

| New Hampshire | Not mandatory, but SR-22 may be required post-conviction or accident |

| New Jersey | Fine: $300-$1000; license suspension for 1 year; $250/year surcharge for 3 years |

| New Mexico | Fine: $300; possible imprisonment for 90 days; license suspension |

| New York | Fine: $1500; $750 civil penalty; license/registration suspension; $8-$12 daily penalties for lapse |

| North Carolina | Fine: $50; registration suspension until proof of insurance; $50 restoration fee |

| North Dakota | Fine: $1500; possible 30-day imprisonment; 14 points; proof required for 1 year; $50 fee |

| Ohio | License/plates/registration suspension; $100 reinstatement fee; high-risk coverage for 3-5 years |

| Oklahoma | Fine: $250; possible 30-day imprisonment; license suspension; $275 reinstatement fee |

| Oregon | Fine: $130-$1000; possible 1-year license suspension; proof required for 3 years |

| Pennsylvania | Registration suspended for 3 months; $88 restoration fee or $500 civil penalty |

| Rhode Island | Fine: $100-$500; license/registration suspension for 3 months; $30-$50 reinstatement fee |

| South Carolina | Fine: $100-$200; possible 30-day imprisonment; $200 reinstatement fee |

| South Dakota | Fine: $100; possible 30-day imprisonment; 30-day to 1-year license suspension; SR-22 required for 3 years |

| Tennessee | $25 coverage failure fee; additional $100 fee if unpaid; possible registration suspension |

| Texas | Fine: $175-$350; $250 surcharge for 3 years |

| Utah | Fine: $400; license suspension; $100 reinstatement fee; proof required for 3 years |

| Vermont | Fine: $500; license suspension until proof of insurance |

| Virginia | $500 uninsured motorist fee; suspension if unpaid |

| Washington | Fine: $250+ |

| West Virginia | Fine: $200-$5000; 30-day license suspension; $200 penalty fee |

| Wisconsin | Fine: $500 |

| Wyoming | Fine: $750; possible 6-month imprisonment |

The National Association of Insurance Commissioners has been championing efforts of states to maintain and increase strict penalties for drivers who do not comply with auto insurance laws because they say it is the most effective way to make sure that drivers do not drive without the proper auto insurance.

For example, the laws in North Carolina tend to be the strictest in terms of penalizing drivers for not complying with auto insurance laws. The National Association of Insurance Commissioners found that North Carolina had the highest rates of auto insurance compliance by drivers in 1989 with 96.6% of drivers maintaining at least the required coverage.

There are extreme penalties for failing to comply with state insurance laws.

Drivers may have their driver’s licenses suspended or revoked. In certain cases, they can also face jail time. It is also possible that your car could be impounded for failure to comply with auto insurance laws.

The penalties increase for each subsequent offense and could make it more difficult for you to eventually get auto insurance from an insurance company.

Given that the cost of not complying with state auto insurance laws is so high, it is definitely worth the small effort to make sure that you have a copy of your insurance card. You should also retain a copy of your actual auto insurance policy.

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

If you’re wondering how to get a new car insurance card, it’s as easy as calling your insurance company or visiting its digital services. Not carrying a valid certificate of automobile insurance could result in fines or even jail time in some states.

Looking to get coverage from the cheapest auto insurance companies? Enter your ZIP code below to compare car insurance rates from multiple companies at once.

To get a copy of your auto insurance certificate, you can follow these steps:

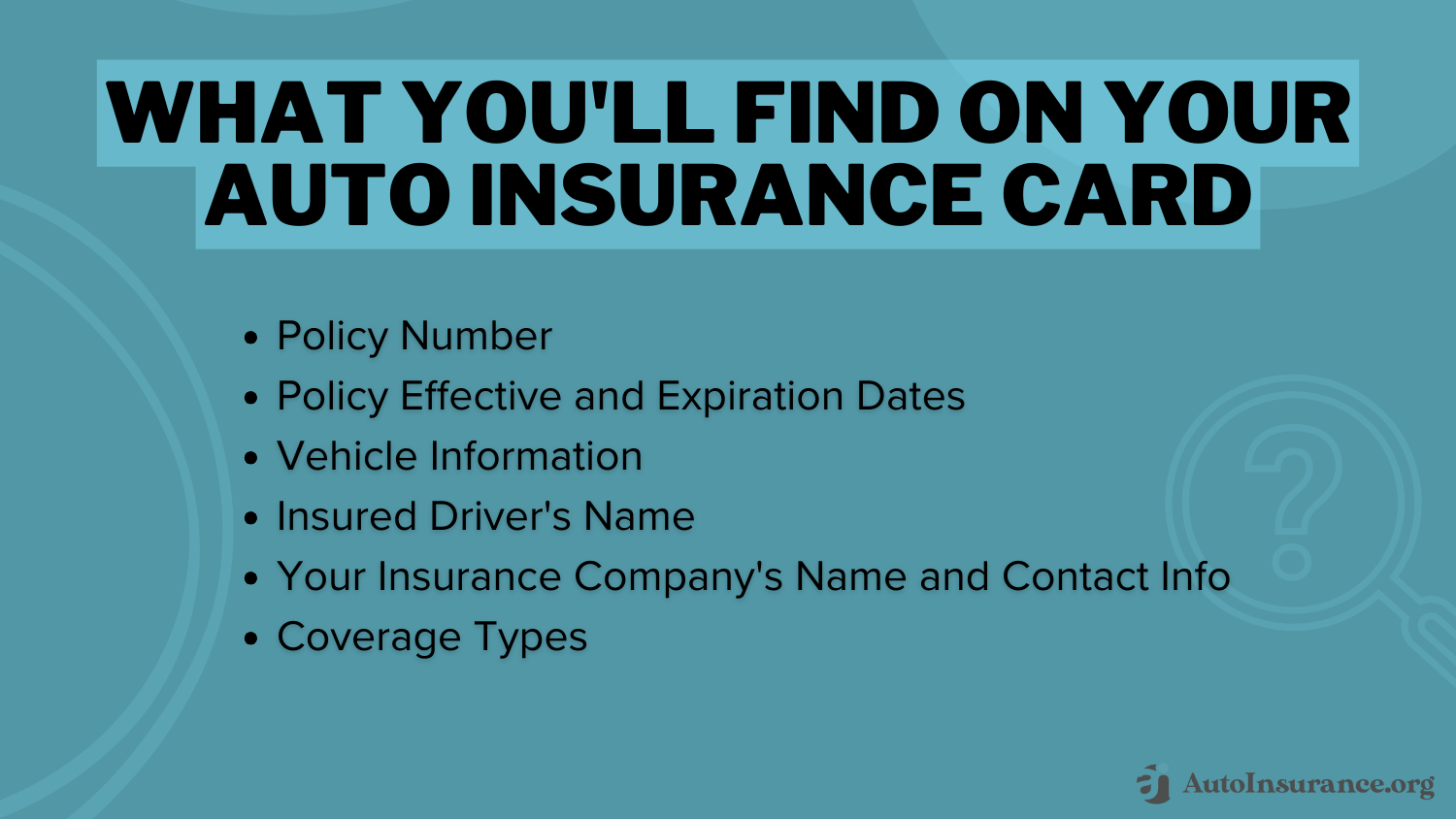

An auto insurance certificate is a document that serves as proof of insurance coverage for your vehicle. It typically contains information such as the policyholder’s name, policy number, effective dates, coverage details, and the name of the insurance company.

If you’re not sure if you’re covered, call your insurance company. You may also be able to check with your state department of motor vehicles or department of insurance to find out what your official status is regarding insurance coverage.

You may be thinking to yourself, “I lost my card insurance card. What should I do?” Simply call you car insurance agent or customer service to request a new copy.

However, readers may also wonder how to get an insurance certificate online. Visit your insurance company’s website and log into your account to get a copy. You can also find a copy on your mobile app. Learn about the best mobile apps for auto insurance here.

There are several situations where you might need a copy of your auto insurance certificate, including:

Yes, many insurance companies offer online access to policyholders, allowing them to view and download their insurance documents, including the auto insurance certificate. Check if your insurance company has an online portal or mobile app that provides this functionality. If so, you can typically log in, navigate to the relevant section, and download a digital copy of your certificate.

If you’re looking for a more tech-savvy insurer with online resources, enter your ZIP code below to start comparing free quotes instantly.

Insurance companies do not charge a fee for providing a copy of your auto insurance certificate. However, it’s advisable to confirm with your insurance provider if any fees or charges apply before making the request.

The time it takes to receive a copy of your auto insurance certificate can vary depending on the insurance company and their processes. In many cases, you can expect to receive it within a few business days. If you need the certificate urgently, it’s best to inform your insurance company about the time sensitivity so they can expedite the process if possible.

An insurance agency may choose not to renew your policy or cancel your coverage completely if you fail to pay the required premiums or if you are not honest on your insurance application. If you are searching for your auto insurance card because you have an issue with your coverage, this is a prime opportunity to consider whether you should shop around for a better insurance rate.

If your current insurance policy has been canceled or not renewed by the insurance company, then you should act immediately to make sure that you retain at least the required coverage under your state law.

Contact your insurance agent or call The General customer service at 1-855-997-8270 to request a new card.

The General policyholders may also wonder how to get an insurance copy online. You can also log into your online account or visit The General mobile app to get your proof of insurance.

Looking for affordable high-risk insurance? Enter your ZIP code into our free quote tool below to compare your The General rates vs. top competitors.

To save your insurance card to Apple Wallet, visit your insurer’s mobile app and locate the section for ID cards. Then, tap on the button that says “Add to Apple Wallet”.

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption