If you receive rental payments for the property you own, you need to make rent receipts (a.k.a rental receipts) a part of your payment process. A rent receipt is a “proof of payment” document that shows the rental price paid, any added fees, and the date the rent was paid.

Rent receipts help you log payments in case there’s ever a dispute with a tenant. But beyond that, rent receipts are important to track your income, fill taxes, and safeguard your investment.

Here’s everything you need to know, including how to fill out a rent receipt.

Filling out a rent receipt is essential to accurately record information you’ll need later. Fields like the payment date, receipt number, tenant information, and payment totals will be helpful for resolving conflicts or reporting your taxes.

Here are the steps for filling out a rent receipt:

Finally, record the payment amount. These fields include:

Note: Many rent receipt templates will automatically calculate totals based on the amounts you enter. This streamlines the process and means you do less math—who doesn’t love that?

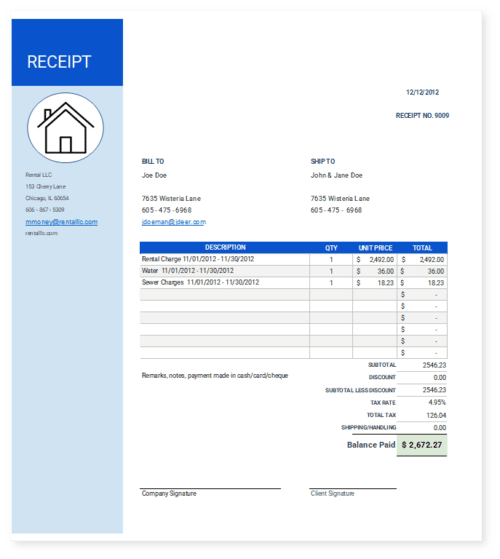

So, what’s a rent receipt look like? The example below shows a receipt that includes all the important information you and your tenants need.

You may find other rent receipts that include less information. However, an itemized rent receipt—like the example above—is preferred. By breaking down each element of the rental cost, you avoid vague records that can cause disputes later on.

Don’t forget that rent receipts aren’t just for you. In fact, many states require landlords to provide tenants with rent receipts. Other states specify that only tenants paying in cash must be provided a receipt.

It’s best to check your state and city ordinances to confirm rent receipt regulations.

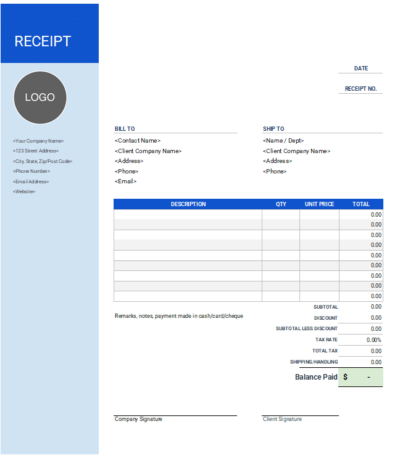

You don’t have to start from scratch. You can use a rent receipt template to create professional, accurate receipts for your tenants quickly.

A good rent receipt template will include fields for all the essential information you need to record with the receipt. It’s preferred that you use an itemized receipt template to outline all the costs contributing to the total rent paid.

Look for a rent receipt template that lets you upload your logo. This personalizes the receipt and makes it look more professional.

Finally, choose a rent receipt template that does the math for you! Many templates include built-in formulas to calculate the total cost automatically, saving you time.

image of rent receipt template" width="400" height="458" />

image of rent receipt template" width="400" height="458" />

As a landlord (or property manager), you’re already busy enough. So, adding another task to your plate might not be appealing. But providing your tenant a rent receipt every time they pay offers you both benefits.

Here’s why your rent receipts are important:

Rent receipts provide a comprehensive record of income received from the property. It’s not as simple as assuming your tenant paid their flat rent price each month. Late payments can change the payment date and increase the balance with incurred late fees.

Rent receipts include a payment date field and a detailed breakdown of line-item costs. So, you easily understand when a payment was made and any increase or decrease from the standard monthly rate.

Come tax season, you’ll appreciate having a complete record of payments to reference for your Schedule E form.

Rental disputes are a common reality for landlords. Unfortunately, this issue is only growing due to COVID-related economic stressors.

In Los Angeles county alone, rent disputes have nearly doubled compared to pre-pandemic numbers. Meanwhile, 54% of landlords surveyed reported increased missed, late, or partial payments of retail, office, and industrial spaces.

Rent receipts provide an unbiased, factual record that can be referenced to resolve disputes. By having a paper trail, you can ensure you’re protected against frivolous lawsuits from tenants.

Hey, we’re only human. Mistakes will be made eventually. You or your tenant may forget that a payment was successfully made in the past or a check might become lost in the mail.

Confusion will only multiply as time passes. Rent receipts give you a clear, accessible record to verify that each monthly payment was made on time.

Now that we understand the importance of tracking rent payments let’s turn to how to store those payments. There are both manual and digital tools to track rent payments. Deciding which is best for you requires weighing what method fits your current workflow and will simplify your daily tasks.

Here are two standard methods for keeping records of rent payments.

Rent receipt books are a good but manual way to keep track of rent payments. Each time a rent payment is made, record the date, amount, and payment method in the rent receipt book. This will provide you with a concise record of all rent payments made.

The disadvantage of receipt books is that it’s a manual process. If you’re managing multiple properties, you may not want another repetitive task on your plate.

An invoice/rent management software—like Invoice Simple —is a digital tool that helps you keep track of your rent payments and client details.

With this software, you can automate tasks, get notified of delivered or read invoices, and monitor your monthly and yearly income. Plus, with one click, export and send reports to your accountant or other team members to make bookkeeping a breeze.

Invoice Simple can help.